Published on 23 September, Fastdata’s 2024 report includes an in-depth analysis of China’s online travel industry, as well as an assessment of the current outbound travel market and consumer trends, based on industry data and a July 2024 survey of Chinese users of online travel platforms.

We’ve translated and summarized most of the report findings; you can read the full original report (in Chinese) here.

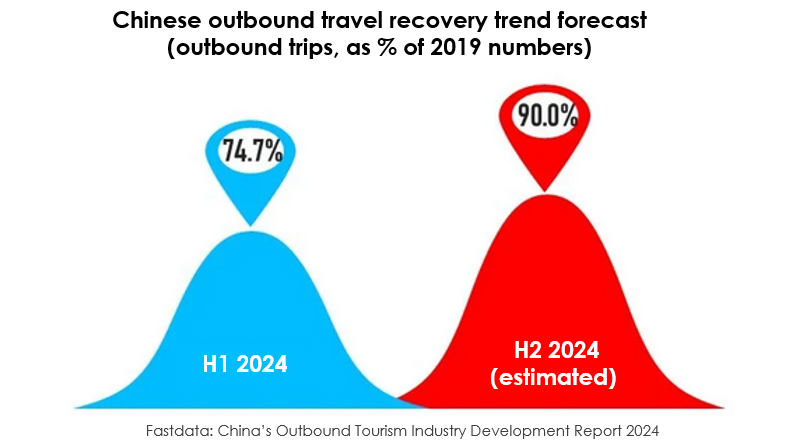

The first half of 2024 saw around 60.7 million outbound trips from China, a year on year increase of 50.4%, and reaching 74.7% of 2019’s numbers. At the same time, outbound travel spending grew by 57.8% year on year, to US$124 billion. Southeast Asia has already recovered to 2019, benefiting from visa-free policies, while burgeoning destination UAE is a dark horse that’s attracting FITs. Europe’s recovery is warming up, with travelers to Italy, the UK, and Spain all coming close to 2019.

Everyone wants to know how to welcome back these travelers and what’s changed about their spending and traveling habits. Fastdata’s analysis shows that the Chinese outbound travel market is now more fragmented and diverse, with travelers seeking out new experiences, cultural exploration, and personalized and independent trips. The competitive Chinese OTA market is well aware of these changes in demand and spending habits, and already adjusting to meet the needs of the new Chinese outbound travelers.

Part 1: China’s Outbound Tourism Market

The report’s authors are extremely optimistic about the future of Chinese outbound tourism. Thanks to factors such as relaxed visa policies and the recovery of flight capacity, they estimate a recovery of outbound tourism to around 90% of pre-pandemic levels by the end of 2024, and full recovery/growth by first half of 2025.

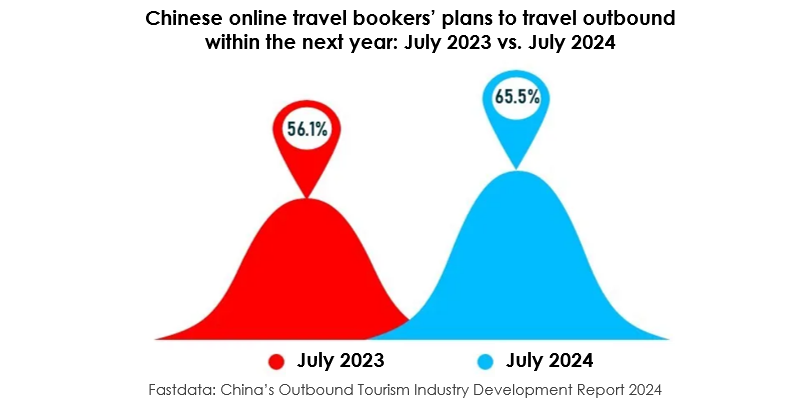

At the same time, they also found a growing intention among online travel booking platform users to travel outbound within the next year.

More than 61% of users want to go on a big trip in the next two years. And 66% of these have already started saving for their dream trip.

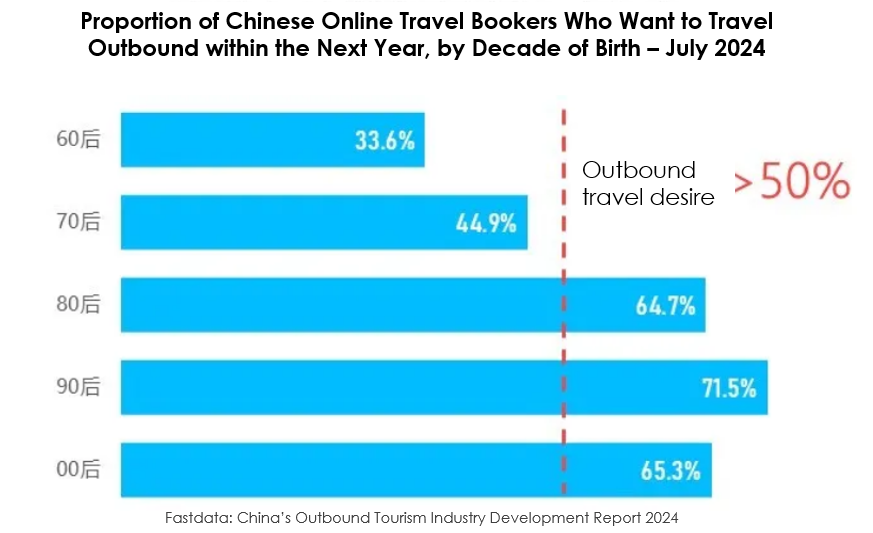

Willingness to travel outbound is especially obvious for younger generations, with 71.5% of users born in the 1990s saying they’re interested in traveling outbound within the year.

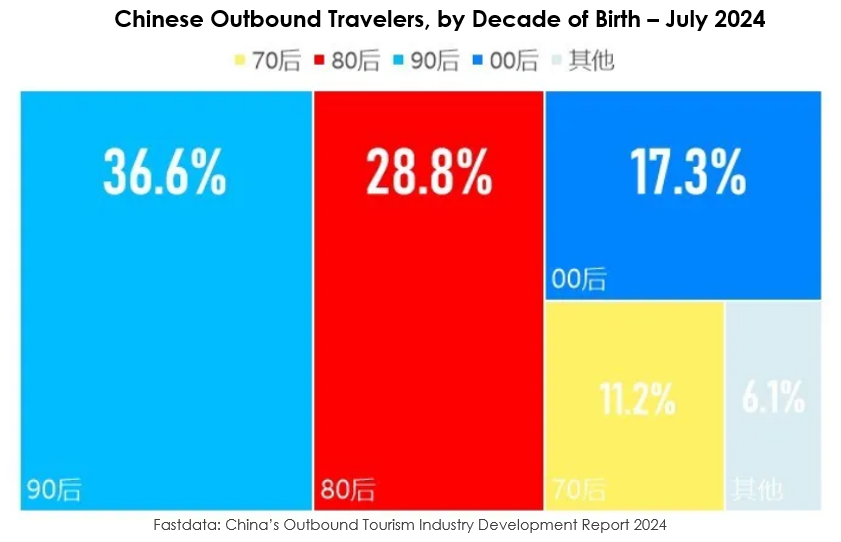

The influence of younger generations on the outbound travel market is undeniable, with post-90s and post-00s generations accounting for more than half. At the same time, the proportion of young people participating in decision making for family outbound trips has grown from 27.3% in H1 2023 to 42.8% in H1 2024.

Spontaneous travel

78% say spontaneous travel appeals to them. 68% like to leave unplanned time during travel to experience local life and culture. 37% of post-90s have already done/booked a spontaneous travel activity.

Solo travel

More and more travelers, especially young travelers, are opting for solo travel to deeply relax, explore interests and make new friends. 76% of young travelers say, they plan on at least one solo trip in the next year.

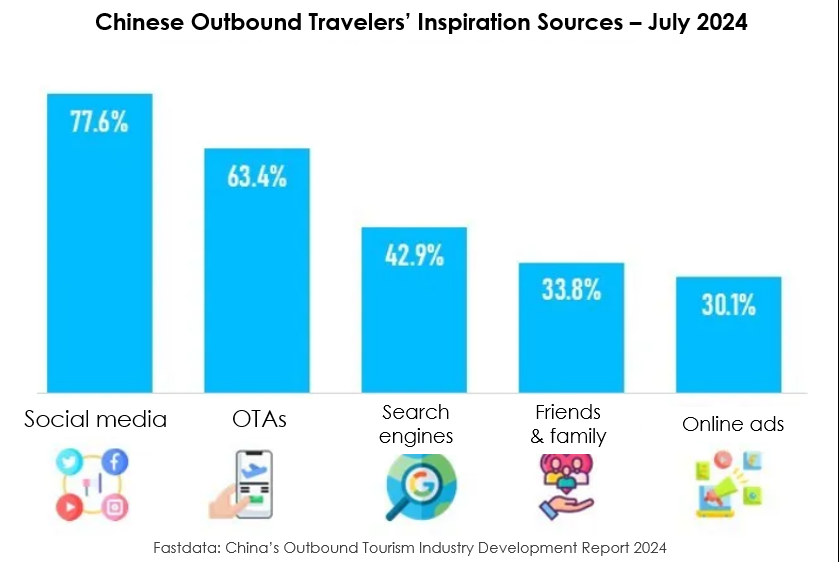

Travel inspiration

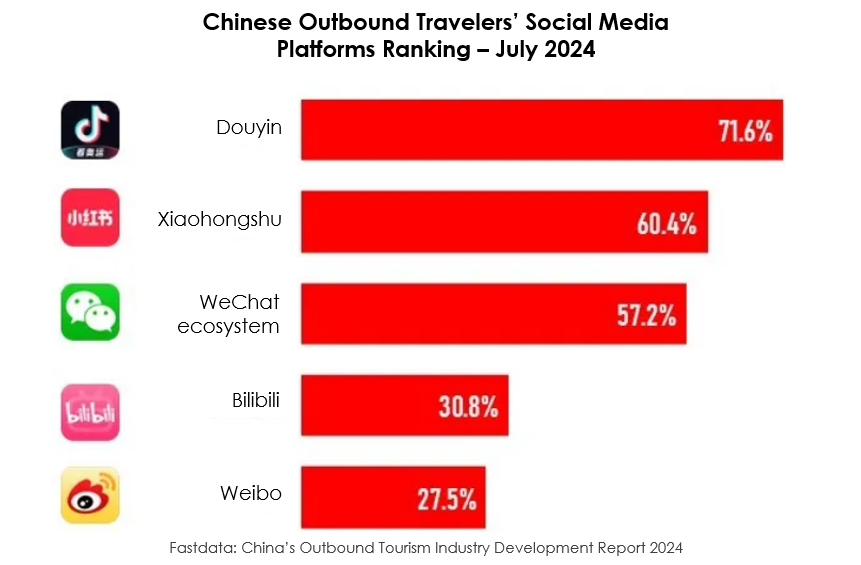

Social media is the most important channel for outbound travel inspiration, followed by OTAs. Douyin, Xiaohongshu, and WeChat are the three top social media platforms for outbound travel inspiration.

Independent travel

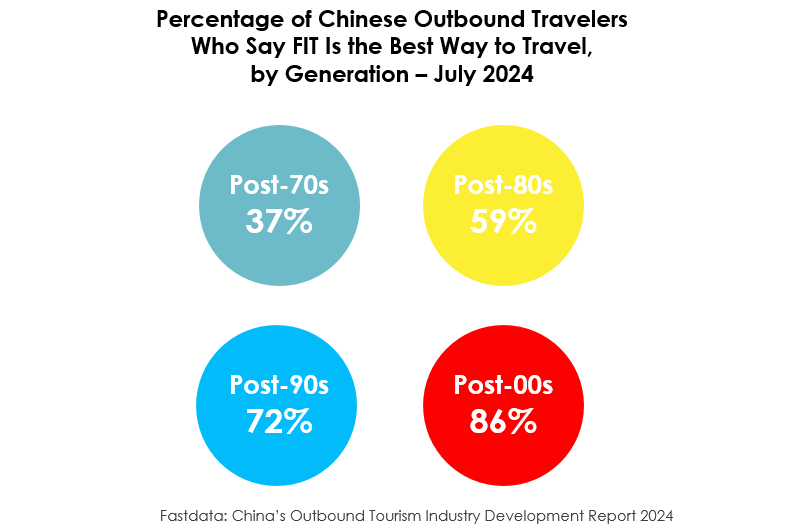

Compared to travelers born in the 1970s and ‘80s, those born in the 1990s and 2000s are more likely to believe that independent travel is superior to group travel, with more flexibility and offering a unique travel experience. Additionally, more travelers are considering FIT than ever before. Among those who traveled as part of a group in 2023, 42.9% said they would choose FIT for their next outbound trip, with 57.1% saying they would again choose group travel. The report also highlights the growth of “Group + Independent” travel, whereby transport to the destination and accommodation is taken care of as part of a group package, but travelers are independent at the destination, organizing their own daily itineraries and meals.

Budgets

Travelers plan to spend around 40% of their budgets on transport to and from their destination, 30% on accommodation, and 30% on entertainment/activities at the destination. The report highlights decreases in the proportion of budget for transport and accommodation, while the entertainment budget – which includes cultural experiences and dining – is growing.

Part 2: China’s Online Travel Market

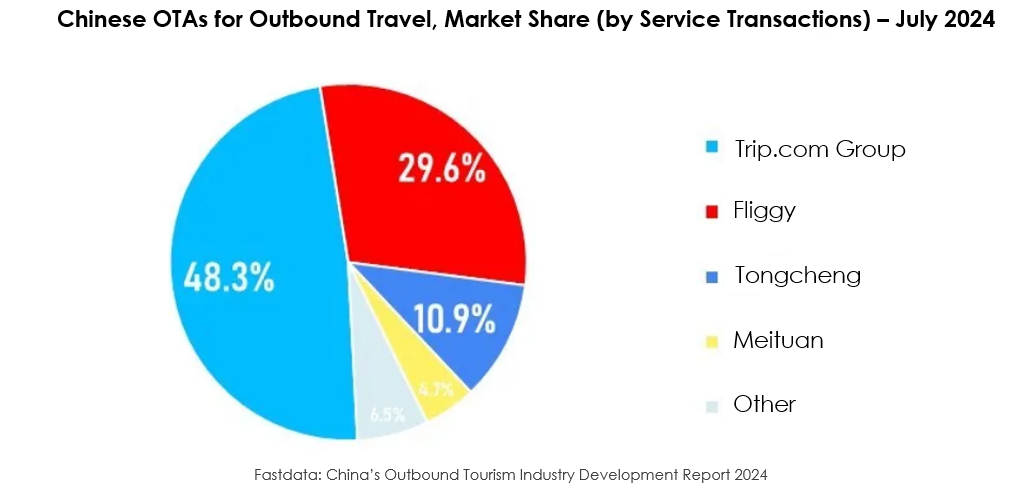

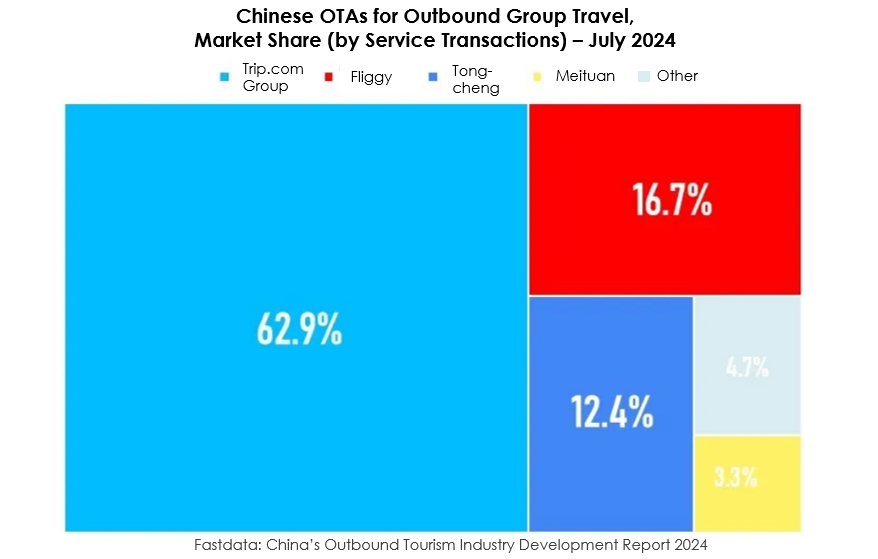

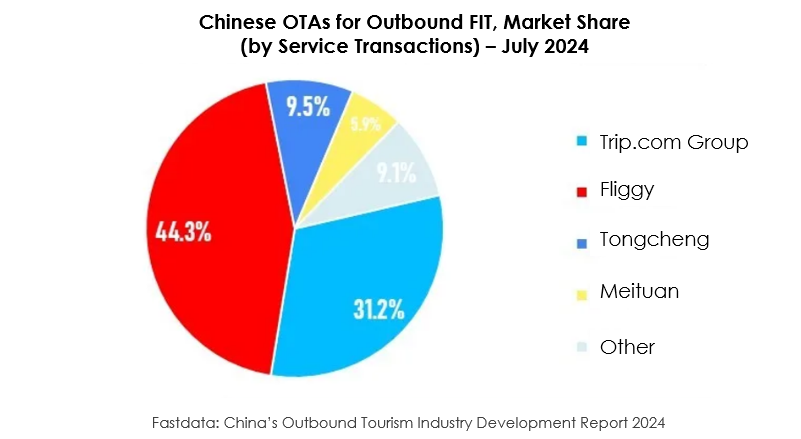

Trip.com Group (Ctrip + Qunar) accounts for nearly half of the market, but Fliggy has grown to almost one-third and ranks second. For group travel, Trip.com Group is more dominant, accounting for 62.9% of the market.

For group travel, Trip.com Group is dominant, accounting for 62.9% of the market. However, Fliggy’s embrace of the youthful FIT trend means it’s the market leader for outbound independent travel

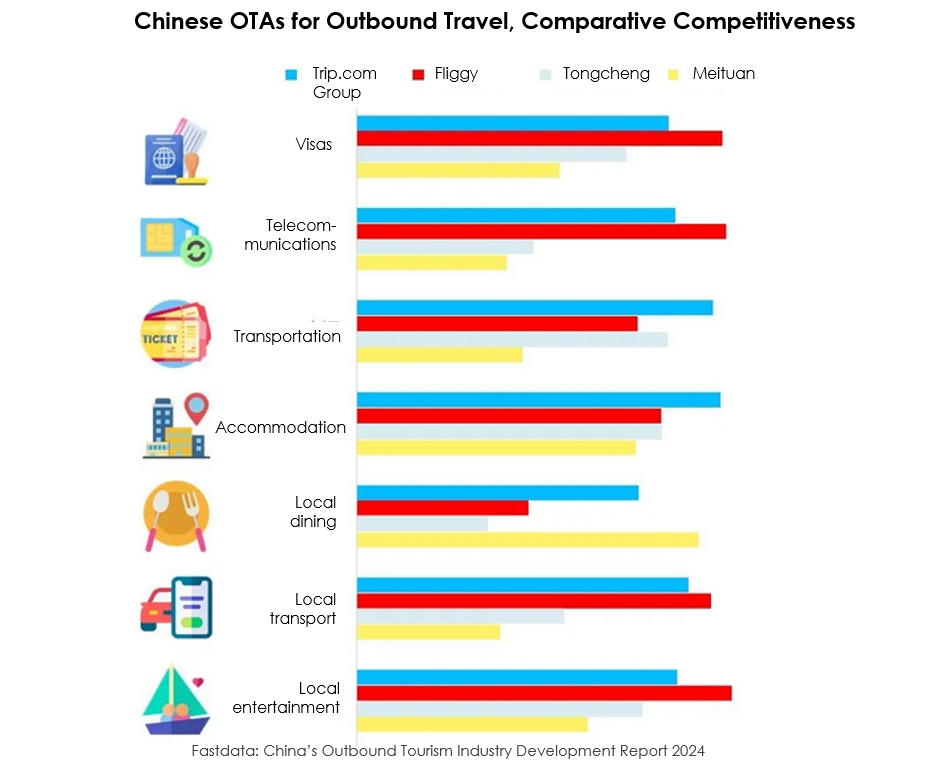

The report scores China’s leading OTAS using a detailed matrix with a large number of factors and attributes, including brand recognition, customer satisfaction, and growth potential, across various sectors such as transportation, accommodation, and visa services.

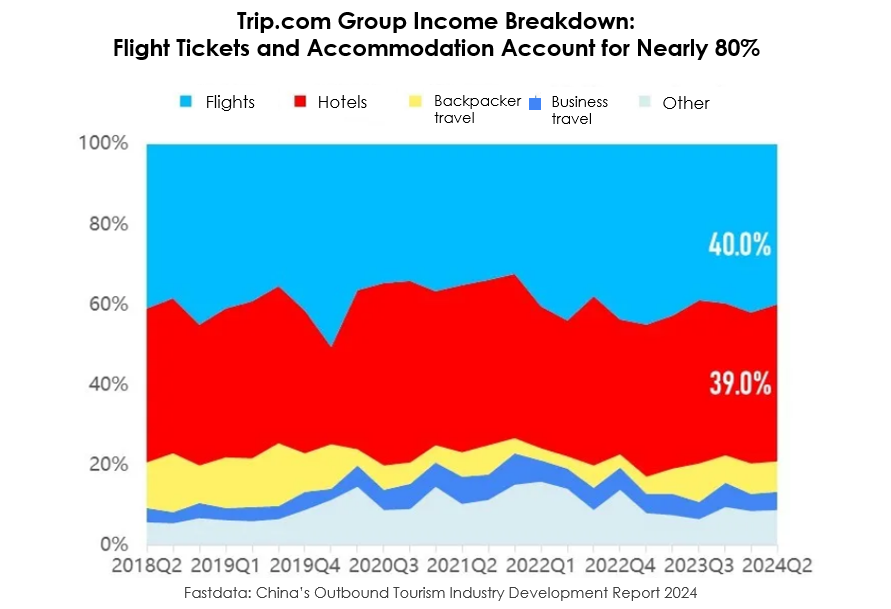

Ranked no. 1 overall, Trip.com’s advantages are having multiple platforms (including Ctrip and Qunar) with a total of 70 million users per month. The company is particularly strong in flight and hotel bookings, which together account for nearly 80% of their business.

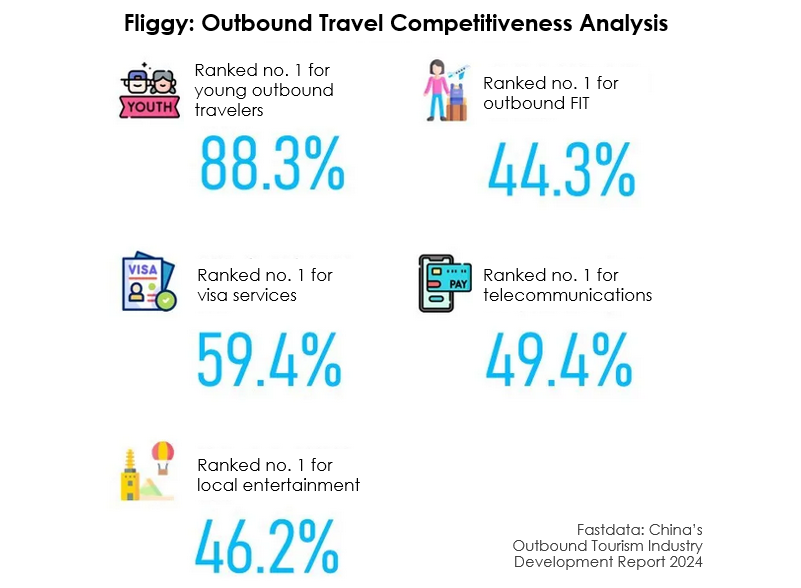

Fliggy gets strength from being part of the Alibaba Group. It’s the market leader for young travelers, FIT, visas, telecommunications, and local entertainment.

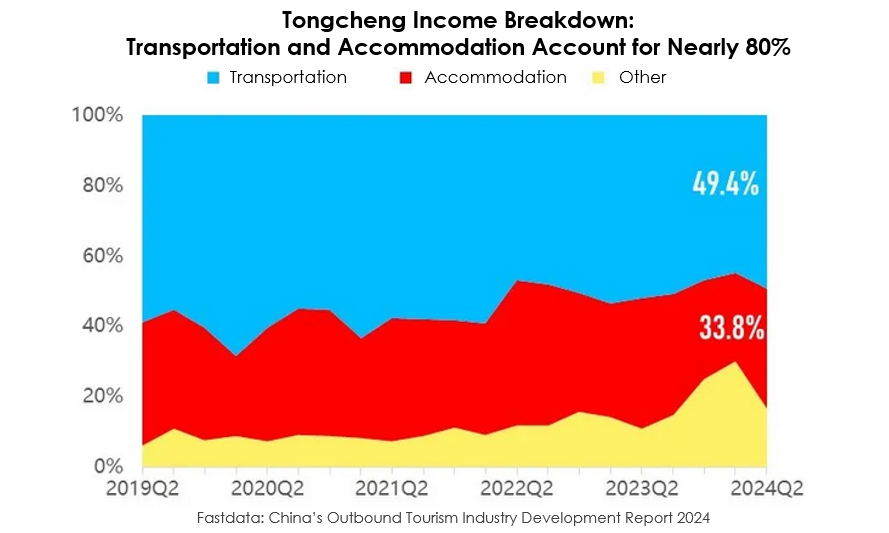

Tongcheng’s (including Elong) strength comes from being integrated into the WeChat ecosystem, with some integration with Ctrip as well. Transportation bookings make up nearly half of their income.

Meituan, which includes Dianping, is strongest with overseas hotel bookings, dining, and attraction tickets.

Part 3: Upcoming Market Trends

Each generation brings its own revolution to the market. For the 1980s generation it was the digitalization of travel. For Gen-Z in the 1990s and 2000s, it’s about diversification, pursuing unique/independent travel and experiences. The report defines them as the YOLO (you only live once) and YDY (you do you) generation.

Public transport has become more welcome, with more than 60% of Chinese outbound travelers planning to take public transport on their next trip. Self driving isn’t just a money-saving measure, but a way to be independent and control your own itinerary. Renting a car overseas is a quickly growing method of travel.

Travelers have embraced outdoor activities in 2024, and interest in outdoor adventure and activities is increasing. This summer saw travelers going on safari in east Africa, heading to island paradises, going on scenic train journeys, and looking for special hiking routes.

Unique and authentic experiences are another key trend. Travelers are seeking out experiences that will give them a feel for local culture, such as traditional vistas, interacting with local people, learning new ways of doing things, and understanding the destination’s history and heritage. By providing individualized and authentic experiences, destinations can attract these new kinds of travelers who are looking for deep experiences and unforgettable interactions.

Health and self-care. Chinese travelers are seeking out destinations where they can relax and restore their spirits. Popular elements of wellness travel this summer included yoga, meditation, and traveling to peaceful places to restore one’s equilibrium.

Travelers are also increasingly attracted to sustainable travel options, looking for destinations and choices that will help to protect environment and local communities.

Sign up for our free newsletter to keep up to date on our latest news

We do not share your details with any third parties. View our privacy policy.

This website or its third party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to the use of cookies.